The Next Summit: Retirement & Private Markets

November 17 - 18, 2025 | Denver, Colorado

Charting the future of retirement investing.

00

Days

00

Hours

00

Minutes

00

Seconds

The industry is at an inflection point. Retirement plans are gaining access to private markets, creating a once-in-a-generation opportunity for asset managers to shape the future together.

Space is limited. Don't miss out!

Featured Sessions

Pioneering Retirement Ready Alternatives

Apollo Global Management, LeafHouse®, and Alta Trust share their experience in launching the first retirement-ready collective investment trust (CIT) featuring private investments.

The Future of Retirement & Alternatives

Learn what’s next for retirement portfolios—and how alternatives will shape the future of retirement income and growth.

9:00 AM

Product-Market Fit: Positioning Private Investments for Retirement Success

Learn how private investments can complement public market strategies in DC plans through thoughtful evaluation, integration, and participant-focused design.

Navigating the Legal Framework

Featuring the nation’s leading ERISA attorneys, Bruce Ashton and Fred Reish, and securities attorney, Vadim Avdeychick, this session delivers the guardrails and guidance you’ll need to succeed in the evolving regulatory landscape.

Distributing Private Markets in DC Plans: Building Access at Scale

Explore how private markets are being introduced into DC plans through new partnerships, evolving distribution models, and innovative approaches to participant access.

Choosing the Right Investments: Balancing Innovation with Fiduciary Responsibility

Identify what sponsors, consultants, and fiduciaries seek in alternative strategies, which types best align with retirement plan objectives, and how they plan to evaluate and monitor them.

Partnering for Growth: Building Hybrid Solutions

Learn how asset managers and service providers are teaming up with private-market specialists to launch hybrid retirement solutions, navigate operational hurdles, and capture new growth opportunities.

Inside the CIT: Building Retirement-Ready Funds

Learn how to structure, operationalize, and position a CIT—covering fund design, platform integration, and distribution strategies—so your product is both retirement-ready and market-fit.

Don't worry. You won't have to choose. All sessions are included in registration.

Meet Our Speakers

Stephen Ulian

.jpg)

Stephen Ulian, Managing Director - Defined Contribution & Retirement, is responsible for developing and executing Apollo’s Defined Contribution and Retirement strategy in collaboration with partners across our platform. Steve brings 30 years of retirement services expertise to Apollo and Athene after having served in executive management roles at Bank of America Merrill Lynch, Fidelity Investments, and Deutsche Bank Scudder Investments.

Prior to joining the firm in 2023, he served as a Managing Director at Bank of America Merrill Lynch, responsible for delivering integrated financial benefits and investment solutions to companies and organizations of all sizes. Prior to Bank of America Merrill Lynch, he served as Executive Vice President for Fidelity Investment’s Workplace Investing Group where his management responsibilities included sales, client relationship management, product management, strategy, and the delivery of integrated services. Before joining Fidelity Investments, Steve was managing director and head of Deutsche Bank Scudder Investment’s Retirement Services.

Todd Kading

Todd Kading is a visionary leader with over 20 years of experience driving innovation in the retirement plan industry. He leads strategy, distribution, investments, and product design, establishing LeafHouse as a premier, technology-driven investment manager and fiduciary for retirement plans nationwide.

Todd partnered with Apollo and Alta Trust to launch the first retirement-ready Collective Investment Trust (CIT) featuring private investments — a milestone that opened the door for alternatives in retirement portfolios.

He also founded InvestGrade IQ, a tech enabled platform delivering advanced analytics, data aggregation, investment scoring, benchmarking, and practice management tools to streamline communication, provide data-driven insights, and increase automation for the retirement plan network.

Todd’s entrepreneurial spirit and commitment to creative disruption drives LeafHouse’s mission to elevate American workers’ financial well-being and address U.S. economic challenges through strategic partnerships.

Jamie Battmer

Jamie Battmer is the Chief Investment Officer at Creative Planning, where he leads investment research and portfolio strategy across both private and institutional channels. With more than 20 years of experience, Jamie has deep expertise in retirement solutions and the integration of private markets into qualified plans.

Before stepping into his CIO role, Jamie oversaw Creative Planning’s retirement services business and previously served as CIO at Lockton Retirement Services. His work has centered on helping plan sponsors, advisors, and fiduciaries design investment structures that blend traditional public-market strategies with alternatives — balancing liquidity, compliance, and long-term performance.

Jamie holds a B.A. from the University of Montana and an M.Sc. in Economics and Economic History from the London School of Economics.

Tony Davidow, CIMA®

Tony Davidow is responsible for developing and delivering the Franklin Templeton Institute’s insights on the role and use of alternative investments through independent research, participating in industry conferences, webinars and engaging directly with key partners and clients. He also serves as the host of the Alternative Allocations podcast series. The Franklin Templeton Institute harnesses the depth and breadth of the firm’s global investment expertise and extensive in-house research capabilities to deliver unique investment insights to our clients.

Prior to his current role, Davidow was retained by Franklin Templeton to develop a comprehensive Alternative Investment educational program for financial advisors. He previously held senior leadership roles with Morgan Stanley, Guggenheim and Schwab among other firms. Davidow began his career working for a New York-based family office and has worked directly with many institutions and ultra-high-net-worth families over the years. He is a frequent writer and speaker with deep expertise in the use of alternative investments, asset allocation and portfolio construction, as well as goals-based investing.

Davidow received the prestigious Investments & Wealth Institute Wealth Management Impact Award in 2020 for his contributions to the wealth management industry; and was awarded the Stephen L. Kessler writing award in

2017, and honorable distinction in 2015. He is the author of "Goals-Based Investing: A Visionary Framework for Wealth Management" (McGraw-Hill 2020), and “Private Markets: Building Better Portfolios with Private Equity, Private Credit, and Private Real Estate” (Wiley 2025). In 2024, Franklin Templeton’s Alternative Investment education program was recognized by WealthManagement.com with a “Wealthie” award for its contribution to financial advisor success.

Davidow holds a B.B.A. degree in Finance and Investments from Bernard M. Baruch College and has earned the Certified Investment Management Analyst (CIMA®) designation from the Investments & Wealth Institute and the Wharton School of the University of Pennsylvania. Davidow formerly served on the Board of Directors of the Investments & Wealth Institute, and served as the Chair, Investment & Wealth Monitor, Editorial Advisory Board.

Joseph M. Smolen

Joe Smolen is Executive Vice President of Core and Institutional Markets for Empower. In his role, he oversees the core market, which consists of retirement plans in the micro, small, and mid markets, as well as the team that partners with Empower’s institutional recordkeeping clients. Joe is responsible for strategy and development as well as all new business acquisitions plus client satisfaction, retention, and financial results for both business segments.

Joe joined the organization in 1999. During his 25-year tenure, he has held numerous sales and leadership positions. As Vice President of Sales Strategy, he led an initiative to recast the core market’s internal sales strategy, and as Regional Vice President for the western territory, he grew sales 24% a year over 10 years. He has also served as a Pension Consultant and was named National Salesperson of the Year twice.

Joe holds a bachelor’s degree in management from Kansas State University. He is the Vice Chair on the board of the Children’s Diabetes Foundation and the Barbara Davis Center for Diabetes and also serves on the SPARK Advisory Board and as Chairman of the SPARK Governing Board. In addition, he is involved with the Tim Tebow Foundation and Habitat for Humanity.

Daniel Oldroyd

Daniel Oldroyd, CFA, CAIA, Managing Director, is a portfolio manager and the Head of Target Date Strategies for Multi-Asset Solutions (MAS). Dan is responsible for leading MAS's Retirement efforts, including the management of SmartRetirement, custom target date funds and SmartSpending. Given its importance in our investment process, Dan also oversees the team's Retirement research both in- and out- of plan. Dan is a member of the SmartRetirement Portfolio Management Team, which was awarded the 2014 Asset Allocation Fund Manager of the Year by Morningstar. An employee since 2000, Dan held several other positions within the firm previously, including that of investment strategist and manager research of non-proprietary investment managers for J.P. Morgan Retirement Plan Services. He earned both a Masters of Arts in International Business and Policy and a Bachelor's of Science in Finance and International Business from Georgetown University. Dan is a CFA charterholder, CAIA charterholder, and is Series 3, 7, 63, and 24 licensed.

Michael Esselman

Michael is the Chief Investment Officer of OneDigital’s Retirement & Wealth. He is responsible for the overall investment platform, including selection of investment offering, due diligence of funds and managers, and overseeing investment strategies and models managed by the investment team. He also works directly with a handful of institutional clients including corporate, non-profit and government entities.

Michael’s team combines quantitative and qualitative aspects into the asset allocation, investment research, analysis and monitoring process to ensure clients are utilizing quality investments. He is also regularly interviewed by industry publications for his thoughts on investment trends across the retirement industry.

Prior to joining the team Michael was an account manager at PIMCO where he partnered with retirement plan sponsors keeping them informed of economic outlooks, investment recommendations and industry trends. He also launched the firms’ first online asset allocation tool used by consultants and advisors across the industry.

Michael graduated from Brigham Young University with a Bachelor of Science (BS) in mathematics and later received his MBA from the same alma mater. He has earned the right to use the Chartered Financial Analyst designation.

Nick Walstrom

Nick Walstrom is the Director of Product Strategy at Principal Asset Management, bringing over 25 years of experience in institutional asset management and private client wealth management. He oversees new product research and development across the U.S. Institutional, Wealth Management, and Retirement segments.

His focus areas include mutual funds, ETFs, separately managed accounts (SMAs), semi-liquid alternative investment funds, collective investment trusts (CITs), retirement income solutions, and target date funds.

Prior to his current role, Nick led the product team at RBC Global Asset Management (U.S.) for nearly 15 years and began his career as a research analyst at a Minneapolis investment advisory firm, specializing in mutual fund and ETF due diligence.

Frank Riccio

Frank Riccio is head of sales and strategic relationships for US Wealth Solutions at First Eagle Investments, responsible for the daily operations of the US Wealth Solutions team and leading the Retail Operating Committee. Frank has more than 20 years of experience in sales leadership. Prior to joining First Eagle in November 2023, he was executive vice president and head of field sales at PIMCO. Before that, he was senior vice president at Allianz Global Investors. Frank earned a BS in business administration from the University of North Carolina at Chapel Hill and holds the CFA designation.

Joseph Szalay, CFA, CAIA

Mr. Szalay is a senior vice president and defined contribution product strategist in the New York office, focusing on target date funds and retirement income solutions. Prior to rejoining PIMCO in 2022, he was a director and senior investment strategist for BlackRock’s retirement solutions team, where he helped design and distribute custom and off-the-shelf target date funds. Additionally, he served as a thought leader on fixed income, lifecycle investing, and retirement income. Before BlackRock, Mr. Szalay was with PIMCO for six years, focusing on institutional consultant relations. He has 19 years of investment experience and holds an undergraduate degree from the University at Albany. He is also a CFA charterholder and CAIA charterholder.

Fred Reish

Fred Reish is an attorney whose practice focuses on fiduciary and best interest standards of care, prohibited transactions, conflicts of interest, and retirement plan issues. He has been recognized as one of the “Legends” of the retirement industry by both PLANADVISER magazine and Plansponsor magazine. Fred has received recognition awards for: AV Preeminent Rating® by Martindale Hubbell; the 401(k) Industry’s Most Influential Person by 401kWire; the Institutional Investor and PLANSPONSOR magazine Lifetime Achievement Awards; one of RIABiz’s 10 most influential individuals in the 401(k) industry affecting RIAs; Investment Advisor’s 25 Most Influential People by ThinkAdvisor; and the ASPPA/Morningstar 401(k) Leadership Award.

Fred currently serves on the CFP Board’s Public Policy Council and is a member of the CFP Board’s Standards Resource Commission. He has written more than 350 articles and four books about retirement plans.

Vadim Avdeychik

Vadim Avdeychik is a partner based in the New York office and a member of the firm’s Investment Management Group. His practice focuses on advising on the structuring, launch and management of registered fund products and other products designed for high net worth and retail investors.

Mr. Avdeychik advises business development companies (BDCs), interval funds, mutual funds, closed-end funds, exchange-traded funds (ETFs) and their investment advisers on the full range of investment management matters. His experience spans the formation and operation of registered investment companies, alternative fund structures, fund governance, regulatory issues involving public and private funds, ERISA and investment company status issues and exemptions.

Mr. Avdeychik is recommended by Chambers Global (2025) and Chambers USA (2025), where clients note that he is “incredibly knowledgeable, approachable and an expert on non-traditional strategies” and “exactly what you are hoping for when you need to call on a partner at a law firm.” He is also a recipient of the Policy Leadership Award from the Institute for Portfolio Alternatives, which recognizes individuals who demonstrate leadership in shaping policy, regulation, and legislation that support the alternative investments industry.

He received his J.D. from Hofstra Law School in 2007 and his B.A. from St. John’s University in 2004 and holds an LL.M. in Securities and Financial Regulation from Georgetown University Law Center. Mr. Avdeychik is the current Chair of the New York City Bar Committee on Investment Management.

Adam Ponder

Adam Ponder is the Chief Executive Officer and co-founder of Alta Trust, where he leads the firm’s vision for making private funds, CITs, and trust solutions more accessible to financial advisors and retirement plan providers. A serial entrepreneur, Adam previously co-founded, scaled, and exited both RIA and TPA firms, bringing deep experience in the advisor-led space.

Under Adam’s leadership, Alta Trust has launched turn-key private fund offerings for investment advisors and delivered innovative CIT structures — helping bridge public and private opportunities in retirement investing. He is also author of Private Funds for Investment Advisers, reinforcing his mission to help firms capture this opportunity without reinventing their business models.

Adam holds a Bachelor’s degree from Brigham Young University. He lives in Colorado with his wife Nicole and their four children, where they enjoy hiking and exploring the outdoors.

Bruce Ashton

Bruce Ashton is the General Counsel of Alta Trust and one of the nation’s foremost experts in ERISA law. With more than 35 years of experience advising financial institutions, plan sponsors, and fiduciaries, Bruce has helped shape the way retirement plans and investment products are designed, governed, and brought to market.

Before joining Alta Trust, Bruce was a senior partner at Faegre Drinker, where he counseled clients on ERISA compliance, fiduciary responsibility, and the structuring of investment vehicles including Collective Investment Trusts. He is a past president of the American Society of Pension Professionals & Actuaries (ASPPA), a frequent national speaker, and has been recognized in Best Lawyers in America and Super Lawyers for his work in employee benefits law.

At Alta Trust, Bruce applies his deep legal and regulatory expertise to guide the launch of innovative retirement solutions that integrate public and private market strategies.

Brian Harriman

Brian Harriman is the Director of Retirement at Alta Trust, where he leads the firm’s push to deliver the next generation of retirement solutions. With over 20 years of experience in retirement services and trust operations, he has helped shape how investment managers, advisors, and recordkeepers bring products to market.

At Alta Trust, Brian is driving efforts to integrate private markets into retirement plans through innovative Collective Investment Trusts (CITs). His leadership focuses on turning complex operational and regulatory requirements into streamlined solutions that create new opportunities for growth, access, and differentiation in the retirement marketplace.

Choose Your Summit Experience

EVENT Registration

Individual Passes

$1,799

Registration Includes:

- Opening Reception

Monday 5-7pm - All Event Sessions

Tuesday 8am-5pm - Breakfast & Lunch

Tuesday - Networking Dinner

Tuesday 6pm

ASCENT Sponsorship

Sponsorship + 2 Passes

$5,000

Sponsorship Includes:

- Brand Visibility

Logo featured on event signage, website, and program materials. - Network Recognition

Align your firm with a curated audience of decision-makers. - Two Full Access Passes

Connect with plan sponsors, asset managers, and innovators shaping the retirement landscape.

APEX Featured Sponsorship

Featured Sponsor + 2 Passes

$10,000

Sponsor the Opening Reception, Lunch, or Networking Dinner

(only 2 per event)

- Premium Brand Placement

Prominent logo visibility on signage, website, and event materials. - Stage Recognition

Opportunity to deliver Welcome Remarks at your sponsored event. - Exclusive Positioning

Stand out as a featured sponsor with only two per event. - Two Full Access Passes

Priority access to sessions and networking opportunities

Attendees are responsible for booking their own travel & lodging.

Gaylord Rockies Resort & Convention Center

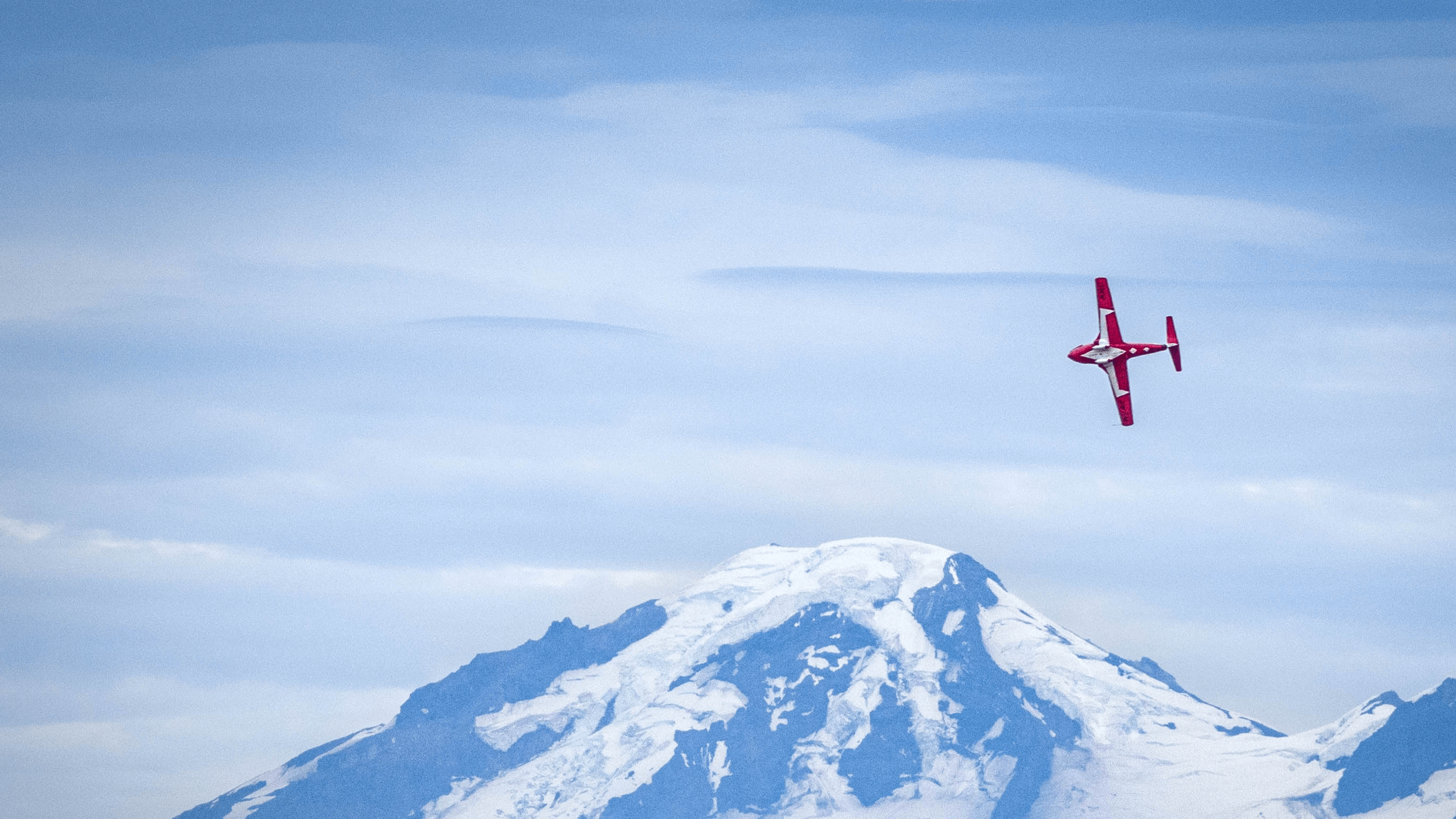

Nestled at the edge of Colorado’s Front Range, the Gaylord Rockies Resort offers a scenic alpine retreat with breathtaking mountain views. Conveniently located just minutes from the airport and close to Denver’s top attractions, it’s the perfect setting for your Next Summit experience. Stay on-site with fellow attendees and enjoy unparalleled networking, exceptional dining, a relaxing spa, and a water park—all just steps away from the event’s meeting spaces.

Book Your Hotel Today for Best Rates

Attendees are responsible for their own travel & lodging for this event.